With two major bill drafts coming through Congress regarding federal regulation of cryptocurrency, not to mention a major court decision regarding Ripple’s XRP token’s security status, summer of 2023 is a good time to demystify the cryptocurrency space. As of March 2023, there were nearly 23,000 cryptocurrencies in existence—too many for anyone to keep track of, let alone understand. Right?

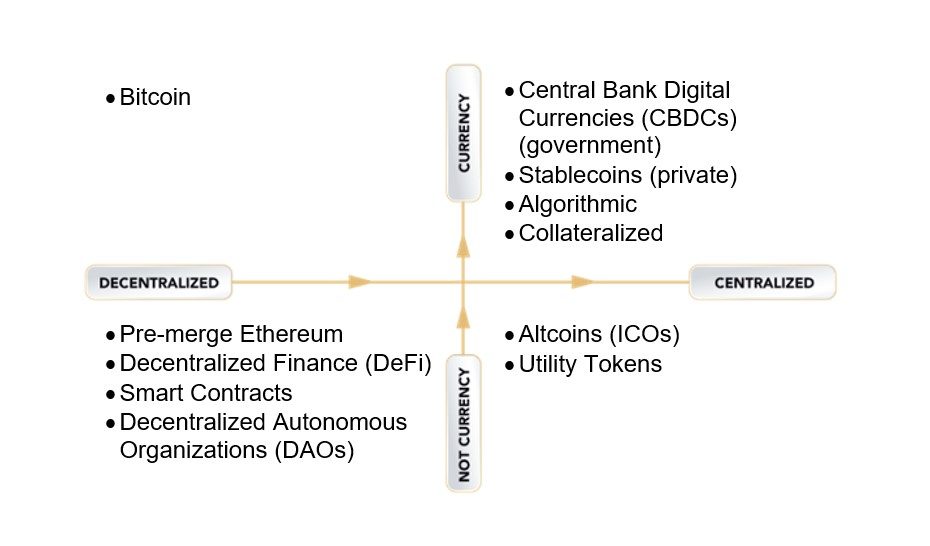

The cryptocurrency space becomes much easier to quickly understand if you consider two axes, forming four quadrants. On one axis, we measure simply whether a cryptocurrency is actually trying to be a currency or is trying to be something else. On the other axis, we measure whether the project is decentralized or centralized. These quadrants are value-neutral—it is not per se better to be in one quadrant or another.

Starting with the top left quadrant (decentralized currency), we have Bitcoin. Alternately lauded and poo-pooed as the original cryptocurrency, Bitcoin takes seriously the challenges of being a currency and has achieved impressive decentralization. While some may put other specific coins in this quadrant, Bitcoin fits squarely.

Moving down to the bottom left quadrant (decentralized not-currency), we find many projects related to decentralized finance, or “defi.” Although defi may still use the name cryptocurrency, and while some of these projects may have a token representing some value, currency is typically not the main problem these projects are trying to solve. Instead, many are focused on “smart contracts,” which execute automatically when certain metrics are reached. The largest network in this space, Ethereum (Ether is the coin, abbreviated ETH), was previously decentralized under a proof-of-work system but moved to a proof-of-stake system in fall 2022. Termed “the merge,” the switch was an impressive engineering feat, but did move ETH toward a more centralized approach.

Heading back up to the top right quadrant (centralized currency), we find two buzzwords: Central Bank Digital Currencies (CBDCs) and stablecoins. Both of these are centralized currencies, but CBDCs have a government (central bank) behind them, while stablecoins are typically run by a company or other private actor. A CBDC is often not a formal cryptocurrency, in that it may not verify transactions through cryptography or the blockchain—this is true of China’s digital yuan. There are many privacy and civil rights concerns related to CBDCs, as they are controlled by governments and those out of favor with the regime may find their transactions tracked or their spending power curtailed.

A stablecoin is typically pegged to a fiat currency and functions as an on- and off-ramp to the cryptocurrency highway. Algorithmic stablecoins purport to use an algorithm to keep the value stable; the Terra Luna crash in 2022 was an example of an algorithmic stablecoin failing. A collateralized stablecoin is backed by a basket of assets that may include fiat currency, treasuries, and bonds. Some stablecoins have been criticized for a lack of transparency regarding which assets back them. Some have compared stablecoins to money market funds, although there is often a hope of at least small returns from a money market, while the goal of a stablecoin is not profit: it is stability.

Finally, moving to the bottom right quadrant (centralized not-currency), we see many altcoins, including utility tokens. An altcoin may be anything from Solana to Dogecoin, and generally speaking includes coins that had an “initial coin offering,” or ICO. While those with specific expertise in these coins may categorize them in a different quadrant, this is a helpful starting place: assume that the coin is centralized if there is a company behind it, and assume that it is trying to solve a problem other than being currency. Utility tokens offer users access to a platform’s features or services and may be particularly useful early in the life of a network by incentivizing participation.

One mistake legislators make in trying to be neutral and “not pick winners or losers” among cryptocurrencies is that they may not understand that coin projects in different quadrants do not necessarily think of each other as competitors or as operating in the same space. Accordingly, applying one set of rules equally to stablecoins, utility tokens, and Bitcoin may sound fair, but instead it will likely (but inadvertently) advantage some projects at the expense of others. Confusingly, many cryptocurrencies are not trying to be currency, which has three main features (store of value, medium of exchange, and unit of account). As we recently saw in SEC v. Ripple, the analysis is not merely about what a piece of technology does, but who is using it and for what purpose. Simply because a project is “digitally native” does not mean that it is more similar to other digitally native projects than to familiar analog tools. Lawmakers who understand these distinctions will create a better legal and regulatory framework to foster innovation and prevent bad actors from succeeding.

Note from the Editor: The Federalist Society takes no positions on particular legal and public policy matters. Any expressions of opinion are those of the author. We welcome responses to the views presented here. To join the debate, please email us at [email protected].